GST rate for Real-Estate Projects w.e.f 1st April 2019

In the GST Council meeting held on February 24, 2019, the decision was made to cut tax on real estate projects to 5 per cent, from 12 per cent. It was also decided to slash the GST rate on affordable housing, to 1 per cent from 8 per cent, as per Finance Minister Arun Jaitley. These changes are applicable from April 1, 2019. Here is an analysis of the possible impact of the Rate cut on the real estate developer as well as the buyer.

Types of Real Estate Transaction

- Supply of Real Estate before completion

- Supply of Real Estate after completion i.e obtaining Completion Certificate

Supply of Real Estate after completion is not liable to GST as per schedule III of CGST Act, 2017.

Rate of GST before 31st March 2019

- Effective rate of GST @ 12% on residential real-estate project other than affordable housing properties.

- Effective rate of GST @ 8% was levied on affordable housing properties.

The above rate is after 1/3rd abatement for cost of land.

Rate of GST from 1st April 2019

The 33rd and 34th GST Council meeting on 24th February 2019 and 19th March 2019, in its Press Release (‘PR’) recommended implementing, from 1st April 2019. Subsequently Notification No 3 to 8/2019- Central Tax (rate) dated 29th March 2019 has been issued by the Central Government, on the recommendation of the Council, effecting the changes:

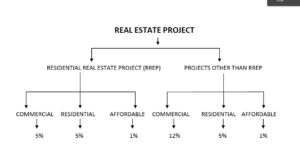

- Revised Effective rate of GST @ 5% on construction of residential apartment other than affordable housing properties by a promoter in a residential real-estate project (RREP) or project other than RREP .

- Revised Effective rate of GST @ 5% on construction of commercial apartment by a promoter in a residential real-estate project (RREP).

- Revised Effective rate of GST @ 1% on construction of affordable housing apartments by a promoter in a residential real-estate project (RREP) or project other than RREP.

The aforesaid rates are after abatement for land value.

The term “promoter”,”Residential Real Estate Project” and “Real Estate Project” has the same definition as under RERA Act, 2016. Accordingly, the term “Residential Real Estate Project (RREP)” shall mean a REP in which the carpet area of the commercial apartments is not more than 15 per cent. of the total carpet area of all the apartments in the REP.

Therefore, where the carpet area of the commercial apartments is more than 15 per cent. of the total carpet area of all the apartments in the REP, it will not be a RREP and the new rates will not be applicable.

Conditions:-

- The tax has to be paid via electronic cash ledger only.

- ITC on inputs and input services used in supplying the services shall not be available.

- ITC attributable to construction in a project,time of supply of which is on or after 1st April, 2019 shall be reversed proportionately.

- Moreover, 80% of the inputs and input services should be purchased or availed from registered supplier only.

- If procurement falls below 80%, GST has to be paid on RCM basis on the short fall @ 18%. In case cement are purchased from unregistered persons, GST @ 28% has to be paid on RCM basis.

- In case of capital goods although the criteria of 80% does not apply, each and every purchase of capital goods should be procured from registered dealers only. In case of purchase of capital goods from unregistered dealer, the entire liability to pay tax would be on the promoter under reverse charge mechanism.

- Input Tax Credit not availed shall be reported every month by reporting the same as ineligible credit in GSTR-3B.

- The Promoter shall maintain Project Wise account of Inward Supplier from Registered and Unregistered Supplier.

Affordable Housing properties

A residential house/flat of carpet area of up to 90 sqm (968.7 sq ft) in non- metropolitan cities/towns and 60 sqm (645.8 sq ft) in metropolitan cities having value up to Rs. 45 lacs .Metropolitan Cities are Bengaluru, Chennai, Delhi NCR (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata and Mumbai.

As per the notification 3/2019-central tax (rate), Affordable Housing apartment taxable @ 1% (Without ITC).

Affordable housing apartment being constructed in ongoing projects under the existing Central and State Housing Schemes can opt to continue at 8% (with ITC).

Since 1% is applicable to “Affordable housing apartment”, even if one or few apartment in a project which satisfies the above condition, it shall be taxed @1% and the remaining residential properties other than affordable housing apartments shall be taxed @5%.

The limit of 45 lakhs will include:

- Consideration charged for the construction of the affordable housing apartment;

- Amount charged for the transfer of land or undivided share of land, as the case may be including by way of lease or sub lease; and

- Any other amount charged by the promoter from the buyer of the apartment including preferential location charges, development charges, parking charges, common facility charges etc.”

Though there is no specific clarity about “one-time deposit”, still one can contend that it being ‘deposit’ the same should not be included in the gross amount charged.

For On-going projects:

For on-going projects,An one time option is given to continue at old rate or to tax at new rate. The option once exercised, it cannot be changed.

- The option is to be chosen project wise and not building wise.

- If the option is not exercised within 10th of May 2019 in Form specified in the notification, new rates will be applicable by default.

For New projects i.e. construction commencing from 1st April 2019, the new rate shall be applicable. For a project to be on-going project, the following cumulative conditions have to be satisfied:

| SNo | Condition |

| 1. | Commencement certificate in respect of the project, (if required by the competent authority) has been issued on or before 31st March, 2019 and it is certified Architect, Chartered Engineer or License Surveyor that construction of the project has started on or before 31st March, 2019 |

| 2. | Certified by an Architect, Chartered Engineer or License Surveyor that construction of the project has started on or before 31st March, 2019 (if Commencement certificate in respect of the project, is not required from competent authority).

Explanation.- For the purpose of point 1 and 2 above , construction of a project shall be considered to have started on or before the 31st March, 2019, if the earthwork for site preparation for the project has been completed and excavation for foundation has started on or before the 31st March, 2019

|

| 3. | Completion certificate has not been issued or first occupation of the project has not taken place on or before the 31st March, 2019; |

| 4. | Apartments being constructed under the project have been, partly or wholly, booked on or before the 31st March, 2019. |

Therefore a Residential real estate project construction of which has started before 31st march 2019 but no booking has been received for any of the residential apartment shall not be considered as on-going project.

Similarly, if construction has started before 31st March 2019 and whole or part booking has been done but if any one or more of the apartment has received completion certificate or has been occupied, it shall not be considered as on-going project.

Ongoing projects opting for new tax rates shall transition the ITC on pro-rata basis based on a simple formula such that credit in proportion to booking of the flat and invoicing done for the booked flat is available subject to a few safeguards.

Commercial Real Estate Property and Mixed property.

Commercial apartments by a promoter in a residential real-estate project (RREP) shall be taxable at 5%. Commercial apartments (shops, offices, godowns etc.) by a promoter in a REP other than RREP shall continue to be taxed @ 12% with Input Tax Credit.

In a mixed project say construction of real estate project where carpet area of commercial apartment is more than 15% then the project will not be a RREP and commercial apartment will be taxable @12% (with ITC) while residential apartment will be taxable only @ 5% (without ITC), then total ITC shall be allowed on pro-rata basis in proportion to carpet area of the commercial portion to the total carpet area of the project.

Treatment of TDR/ FSI and Long term lease for projects commencing after 01.04.2019

- Supply of TDR, FSI, long term lease (premium) of land by a landowner to a developer shall be exempted subject to the condition that the constructed flats are sold before issuance of completion certificate and tax is paid on them.

- Exemption of TDR, FSI, long term lease (premium) shall not be available in case of flats, which remain un-booked on the date of issuance of completion certificate, but such withdrawal shall be limited to 1% of value in case of affordable houses and 5% of value in case of other than affordable houses. This will achieve a fair degree of taxation parity between under construction and ready to move property.

- The liability to pay tax on TDR, FSI, long term lease (premium) shall be on the Promoter instead of land owner under the reverse charge mechanism (RCM).

- The date on which builder shall be liable to pay tax on TDR, FSI, long term lease (premium) of land under RCM in respect of flats sold after completion certificate shall be the date of issue of completion certificate.

- The liability of builder to pay tax on construction of houses given to land owner in a JDA is shifted to the date of completion.

Impact of new rate on buyers

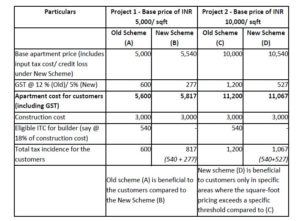

While on the face of the invoice it might appear that the revised GST rate is lower than the earlier GST rate, the New Scheme does not allow Developers to avail ITC on their procurements, which is bound to increase the cost of construction of apartments, which in turn will result in a higher cost of construction to the Developer on which the new (lower) rate of GST will be applied.

On evaluation of the cost of transitioning into the new rate scheme at a project level, the old rates though higher may in fact be more cost beneficial for the customers for most of the on-going projects as compared to the new rates. The only exception to this could be high end projects/ projects in specific areas where the square-foot pricing exceeds a specific threshold or in case of Metro-cities where cost of the land is higher than cost of construction. This has been explained through an illustration as below: